You Can Disable Instructions And Do "What If" Experiments

You can experiment with using different instructions, one at a time, to test the "What If" results of these instructions. Any instruction, a deposit, a withdrawal, a transfer, a cost, a beneficiary, or a parameter change can be disabled temporarily, and then a calculation can be run to obtain the result without the effect of the disabled instruction. Then the instruction can be enabled and another instruction disabled for another calculation run to compare the results.

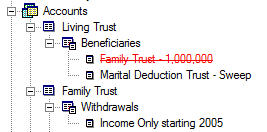

The tree view display for the instruction's node is changed to red with a strike-through font to indicate a disabled instruction. An example is shown below.

A fast way to disable and enable instructions is available. Just double click on an instruction to toggle between disabled states for fast what-if testing of A/B comparisons. Under the Documentation Pages menu select "DoubleClick Instructions To Disable" for the documentation page.

Experimenting With Parameter Change Instructions

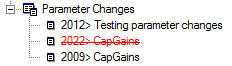

If you want to try different parameter specifications to see the results of experimental parameters, you can define several different parameter change instructions, and then disable all but the one you want to test. This lets you disable the effect of a parameter change instruction without having to delete it. And you can enable it again without having to reenter the data. An example is shown in the figure below.

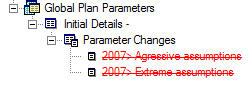

By using this technique, you can experiment with multiple sets of global plan details. Simply define several different parameter change instructions, all for the plan calculation start year. Each one is marked as disabled. Then you can modify the default global plan details as you wish. Just select one of the parameter change instruction and use the edit procedure to enable it. To change to another one, you must disable the active one first, otherwise an edit error is reported since there are conflicting parameters for the same year. See the figure below.

By using this technique, you can simulate the effect of a bear market by setting your global return on investment (ROI) value to zero starting at a given year, then setting it to another value at a later year. This will let you experiment with the results of bear market investment returns in your retirement portfolio.

Experimenting With The Sequence Of Accounts Used To Withdraw Retirement Funds

The data editing window for the specifying the sequence of accounts used for shortfall withdrawals is in the second screen of the parameters data edit dialog.

A description of this capability is available under the Documentation Pages menu. Select "Shortfall Sequence Ranking Of Accounts" for the page.

By using this capability you can change the specified order of account withdrawals, and even change the order multiple times through your retirement years. This lets you examine the impact of taxation and loss of earning power unique to the individual accounts. The data editing window is shown below.

Source Ranking Display (Year 2015 Row Selected)