Use Decision Rules To Improve Your Retirement Withdrawal

Results

Every one wants to know how much they can withdraw from their retirement accounts to fund the expenses of their retirement lifestyle without exhausting their retirement portfolio. The problem is that varying rates of earning on your investments, varying rates of inflation, and varying tax consequences of certain withdrawals all combine to make it difficult to decide on a plan for safe withdrawals. Withdrawal decision rules provide parameters for changing the withdrawal rates that affect living expense funding during retirement years. The Forecaster program provides a way to use these rules to find the strategy to follow for achieving the best outcome.

Videos showing how to use withdrawal decision rules to improve your retirement portfolio payouts.

(These videos assume you have some familiarity with the Forecaster program.).

Demo 1 - Intro and simulation of Klinger's example with income tax added (15 min)

Demo 2 - Example with IRAs, pension income, and living expenses varied (11 min)

Demo 3 - More complexity with bear market investments, plus state income tax (8 min)

Forecaster Decision Rules Demo Plan Files (ZIP file)

Some recent research, using statistical probabilities of possible future rates of earning and inflation, has come up with rules of thumb such as withdrawing 4 percent per year over a 30 year retirement period.

A paper published by the Journal of Financial Planning in

2007,

written by William J. Klinger, titled "Using Decision Rules to Create Retirement Withdrawal

Profiles" shows that by applying some simple rules regarding the

size of your withdrawals, the sustainable portfolio withdrawal rate can be

higher than the rule of thumb rate. (These rules are explained later.)

But the paper does not consider tax consequences. What if your financial situation is

more complex than the simple assumptions in recent research and most retirement calculators? For

instance, most calculators do not attempt to model the impact of taxes on their

analysis. Just specifying

a withdrawal of X dollars does not account for possible tax costs on the

withdrawal. Those tax costs reduce the amount actually available for living

expenses. And what about the effect of taxes due on social security and pension income and

minimum required withdrawals from IRA accounts on the net payouts for living

expenses?

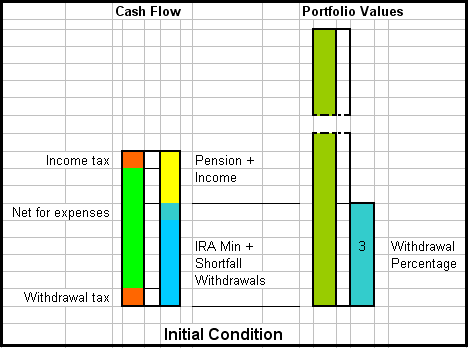

Consider

the problem of tax liabilities. An illustration of this situation is

shown

below. In the left hand side, the green defines the net after-tax money

desired

for retirement living expenses. The yellow and blue define sources of

money.

They have to add up to cover not only the living expenses, but also the

tax

amounts due, shown by the red. These taxes include capital gains tax

and IRA distribution tax (called withdrawal tax in the figure). The Forecaster program asks you for your desired after-tax

money, the green bar in the left hand side.

When the Forecaster program knows more detail about your

financial situation, then it can determine the after-tax value of your pension,

and it can determine the after-tax value of any minimum distribution

requirement from your IRAs. These amounts are used for your retirement living expenses,

but may not satisfy the total amount. In that case there is a shortfall and

other withdrawals will be done to makeup the shortfall. These withdrawals are

taken from accounts that may have certain tax consequence. The Forecaster

program uses its knowledge of these taxes to increase the withdrawal amount so

that the after-tax proceeds satisfy the shortfall in your living expenses.

Depending on account balances, the tax consequences may be different year to

year as different accounts are used, and the Forecaster program accounts for

this in its analysis.

Forecaster lets you specify your desired after-tax living expense amount, and

the program determines how much to withdraw to produce that amount after all

the tax consequences and other financial circumstances are considered. To do

this the program must know more about your retirement assets. How much is your

social security and pension, how much savings is in Roth IRAs, how much is in tax-deferred

accounts, how much is in long-term capital gains accounts? And in what sequence

are you using these different accounts for withdrawals?

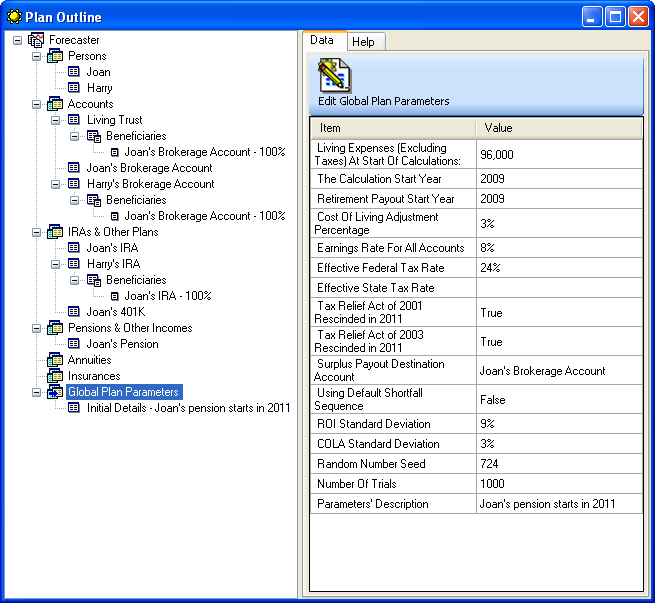

A screen

shot of how the Forecaster program represents your information looks like the figure below.

(All screen shots are from running the example plan file "Example Decision Rules For Knowledgebase.frc".)

The

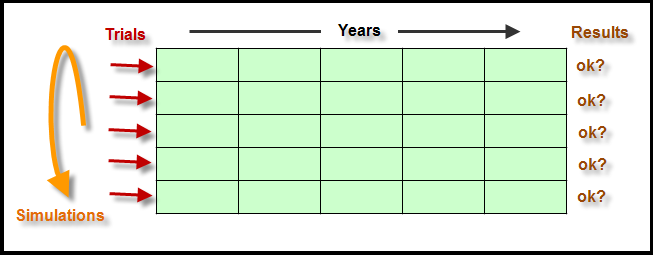

Forecaster program includes test routines that use Monte Carlo simulation. A Monte

Carlo simulation runs a sequence of trials to test the results of withdrawing

money to fund your retirement living expenses. A single trial, using randomly

generated return on investment (ROI) rates and cost of living adjustment (COLA) rates for each year, calculates all the money

transactions, including tax consequences, to arrive at a final result.

The Monte Carlo simulation runs as many trials as specified

by you, and then determines the probabilities for each of the results seen.

Each of the trials results in a final portfolio value, and a counter is kept

for each value that corresponds to a certain range. The number in each range,

evaluated against the total number of values, gives the probability of the

result falling within that range.

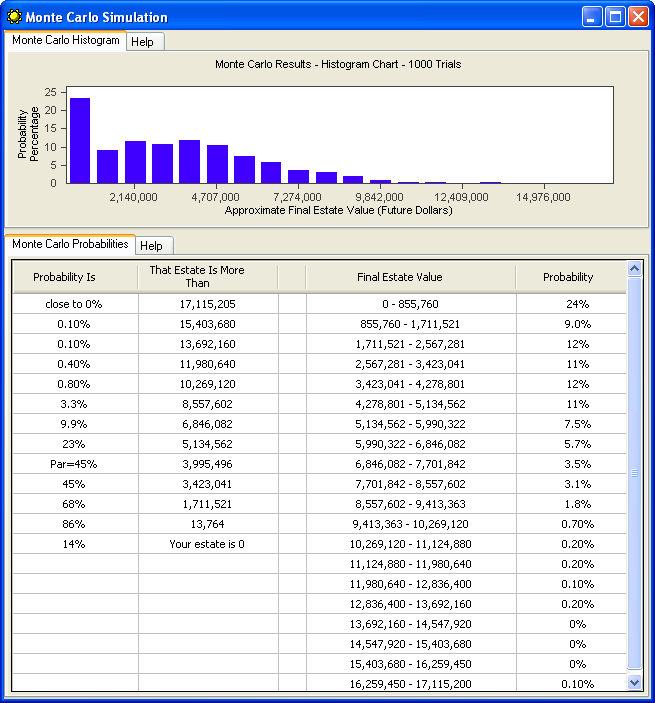

The result of the plain Monte Carlo simulation, without using withdrawal decision rules, looks like the

diagram shown below. The vertical bars are proportional to the number of times

a value within the corresponding range was seen. Notice the high proportion of

times when the portfolio went broke. In 14% of the trials, your portfolio ran out of money before the end of life expectancy.

To improve the odds of not running out of money a retiree can apply the

ideas of the Klinger paper,

which defines three rules that are used to change the size of yearly withdrawal rates:

(1) The Prosperity Rule raises the withdrawal rate when the portfolio

has a good year and the rate would otherwise fall below some threshold.

(2) The Capital Preservation Rule cuts the withdrawal rate increase

when it would otherwise exceed some threshold. (3) The Modified Withdrawal Rule

freezes the withdrawal rate when the portfolio has a negative year and

the inflation adjusted rate is beyond some threshold. The withdrawal

rate may thus be raised, cut or frozen, depending on the

portfolio performance and inflation. The Monte Carlo simulation

creates test cases of both bad and good years, and applies these rules

to adjust the portfolio withdrawal rate accordingly.

The Forecaster program gives you the capability of using these

withdrawal decision rules to explore their effect on the sustainability of your

portfolio withdrawals while also modeling the impact of taxes on the analysis. But instead of asking you for a starting withdrawal rate, as done in the Klinger paper, the program uses the after-tax

living expense

amount that you specify in your Forecaster plan file. If your

Forecaster plan starts before you retire, your specified living expense

amount is increased by the plan's COLA rate each year to estimate the living expense amount at the time of retirement.

Starting

with your after-tax retirement living expense amount, the Forecaster

program uses its knowledge of your assets to determine the actual

withdrawal

necessary to produce this living expense amount, taking into account

your

entire financial situation. This includes accounting for your pension

and other

income, IRA distributions, special cost instructions you specified for

sinking

fund accounts, and all the subsequent tax consequences. The tax rate

used is the effective tax rate as specified by you in your Forecaster

plan.

With the

resulting withdrawal amount, the Forecaster program uses your portfolio value

to calculate the withdrawal rate. This rate is used as the input to the

decision rules simulation logic. This logic uses the Modified Withdrawal Rule,

the Capital Preservation Rule, and the Prosperity Rule to modify the withdrawal

rate as appropriate. (These rules are described later.) Then the modified withdrawal rate is used by the

simulation logic to calculate a new after-tax amount available for your

retirement living expenses. This resulting value is used by the Forecaster

program’s cash flow projection routines for the year. Then this value is

adjusted by the inflation factor (COLA) to get the next year’s requested living

expense amount, which starts the procedure again.

A single

simulation trial does this procedure for each year in your retirement lifetime.

And many simulation trials are done to determine the success rate of your

withdrawal plan. The success rate is the ratio of the number of simulation

trials that leave some money in your estate, to the total number of simulation

trials. A success rate of 99% is the suggested goal to give you a high degree

of confidence in your plan. Remember that the information in these

forward-looking projections is based upon assumptions that involve risks and

uncertainties, and actual events or results may differ materially.

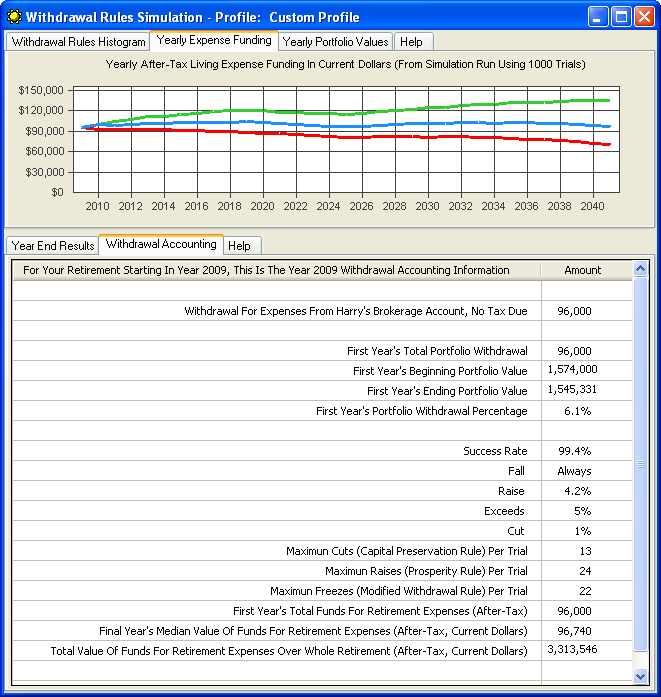

After the Forecaster program has finished a simulation using

multiple trials, a

window is created to show you the results. The window has charts and tables.

The chart pane of the widow shows a histogram of estate value probabilities, a

line chart of yearly expense funding, and a line chart of yearly portfolio

values. The table pane shows probabilities of year end results, and some

withdrawal accounting information that itemizes the first year’s transactions.

The result after running the example plan file is shown below.

Note that the portfolio went broke less than 1% of the time when using withdrawal decision rules

compared to 14% of the time without using any rules. The values used for the withdrawal decision rule parameters Fall, Raise, Exceeds, and Cut (described later) are shown in the table.

Each curve represents a specific

percentile of the range of results from the trials performed during the withdrawal decision rules simulation. The top green line is the 90th percentile. That is, 90% of

the results are less than this value each year. The middle blue line is the

50th percentile. This is the median of all the results for each year. The

bottom red line is the 10th percentile. Ten percent of the results are less

than this value each year. The output

values for the withdrawal

decision rules simulation are calculated as current

dollar values. Current dollars are dollars from other time periods converted

into present-day dollars, in order to factor out the effects of the simulated

inflation rates.

To improve

your success rate, you can modify the parameters of your Forecaster plan file.

The most obvious change to make would be to lower your requested retirement

living expense amount. You can alter the assumptions that you have entered,

such as rates for investment returns and inflation, and tax rates. Don’t forget

that these parameters can be specified as having different values for different

years during your retirement by using the parameter change instructions.

See

the parameter change knowledge base article.

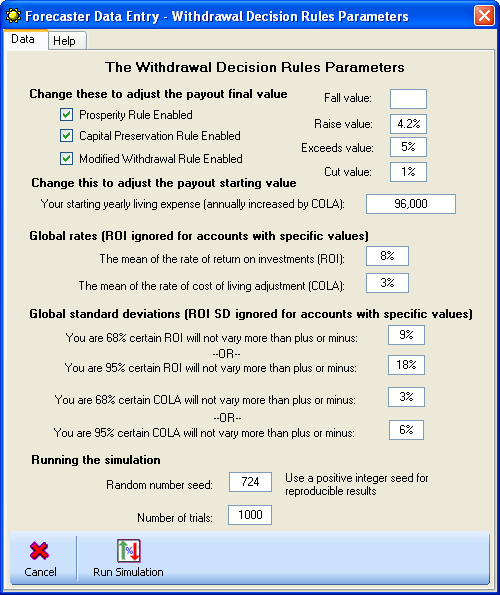

To change the shape of the median value curve (the blue

line) you modify the values of the withdrawal decision rules parameters. These

can be changed in the data entry window that is presented to you before each

simulation run. See the figure below.

Please read

the Klinger paper for an understanding of the withdrawal

decision rules and how they can

affect your withdrawal results. The chart and table shown above were

created using the example plan file "Example Decision Rules For

Knowledgebase.frc"

with the decision rule parameter values shown here.

Fall, Raise, Exceeds, and Cut are variables that are set by you in this data entry

window. In addition, whole decision rules can be activated and deactivated

using the check boxes.

Prosperity Rule. If

the withdrawal rate in any year falls below the initial withdrawal rate by more

than a percentage Fall, the withdrawal rate is increased by a percentage Raise

Capital Preservation Rule. If the withdrawal rate in any year exceeds the

initial withdrawal rate by a percentage greater than Exceeds, the withdrawal rate for that year

is cut by a percentage Cut.

Modified Withdrawal Rule. When the retirement portfolio growth for the year is

negative and when the new withdrawal rate would be greater than the initial

withdrawal rate, then there is no increase allowed in the withdrawal rate. It

is held at the last year rate. There is no make-up for a missed increase.

Note the blank data entry box

for the Fall value.

The

Forecaster simulation logic has added one modification to the range of possible

values for Fall and Exceeds. These variables can now be blank (empty). When blank, the decision rule is always

applied, that is, the change specified by Raise or Cut is always applied. Note that the Modified

Withdrawal Rule can

still override and negate any increase from the other rules.

After each

simulation test, you examine the simulation outputs, and you make adjustments

to the decision rule variables for another simulation test.

The

Klinger paper puts the desired success rate at 99%. If your success

rate is 100%, you may be too conservative, and can afford to try for a

higher output for your retirement living expenses.

You should keep adjusting the parameter variables to obtain an output

result that shows just a 1% probability that your estate is 0, and

shows the desired final year’s payout.

During your retirement, the withdrawal decision

rules simulation should be run each year to arrive at the best withdrawal for

the year. By running the Forecaster program each year, using updated current

account values and the newest estimates for rates of investment return and

inflation, you can obtain a year-by-year guide to a sustainable

portfolio withdrawal plan.

Remember

that Forecaster’s creators are not financial planners, but are computer

programmers, and Forecaster’s internal processing logic, like all computer

software, may contain errors and omissions. The information from Forecaster’s forward-looking

projections is based upon assumptions that involve risks and uncertainties, and

actual events or results may differ materially. Information presented by the Forecaster program does not

constitute financial advice, and is made available to you solely for

informational purposes. The creators do not make any representation or

warranty, express or implied, as to the information’s accuracy or completeness.

Forecaster

does not make specific asset or security recommendations. You enter your desired

retirement year, income and retirement expense information, and expected

lifetime. Forecaster then runs simulations based on the

information provided to determine if your assets are likely to cover your

expenses over the life of the plan, during market conditions based on your

estimates. Results may vary with each use and over time.