Version History

Forecaster Retirement & Estate Planning

Fix problem with payout from a variable insurance policy

Set variable insurance policy's year end balance to zero after payout to beneficiary.

Fix problem with earnings for a variable insurance policy

Fix the required condition for adding investment income to variable insurance policy, it now is "insured person is alive", it was the "owner is alive".

Fix Some Parameter Bugs

Save edit changes to the initial default tax law values over a plan close and reopen. Accept 0% for a specified IRA tax rate. Allow the transfer data entry 2nd page to accept 0% tax rate. Add test of IRA transfer to non-IRA dest to flag it as an IRATaxableDistribution.

Internal Operation Bug Fixes

Fixed an omission of testing for the NoPenaltyTax user option when withdrawing IRA funds. Other internal bug fixes.

Final Estate Accounting

Fixed error calculating the residual estate value caused by not subtracting the income tax paid when bequest was withdrawn from an IRA account.

Monte Carlo Fixes

The usage of the randomized rates is again changed. Now when Forecaster4 runs a trial it obtains a different random Cola rate and Roi rate before each year. And those two selected rates are then used in the calculations during that year. Fixed the "Cola For Indexes" check box option in the Monte Carlo data entry page; it now works to trigger that function. The simulation was fixed to properly randomize the plan's inflation adjusted living expenses amount each year.

Pensions and Income Fixes

There were problems with indexing of pensions; these have been fixed. The data entry page for beneficiaries has been redone to match the needs of the type of pension and income. Only one beneficiary is allowed. Pensions with a contingent payout option must use the spouse as beneficiary. A beneficiary of a non-contingent pension must be a person. Since a principal's pension is income which is put directly into the funds collected to fund the living expenses, it is not ever associated with an account. So the beneficiary's pension payment should continue to be associated with a living person. (Note that incomes cannot be indexed.)

Fix For Problem With Parameter Changes Added to Assets

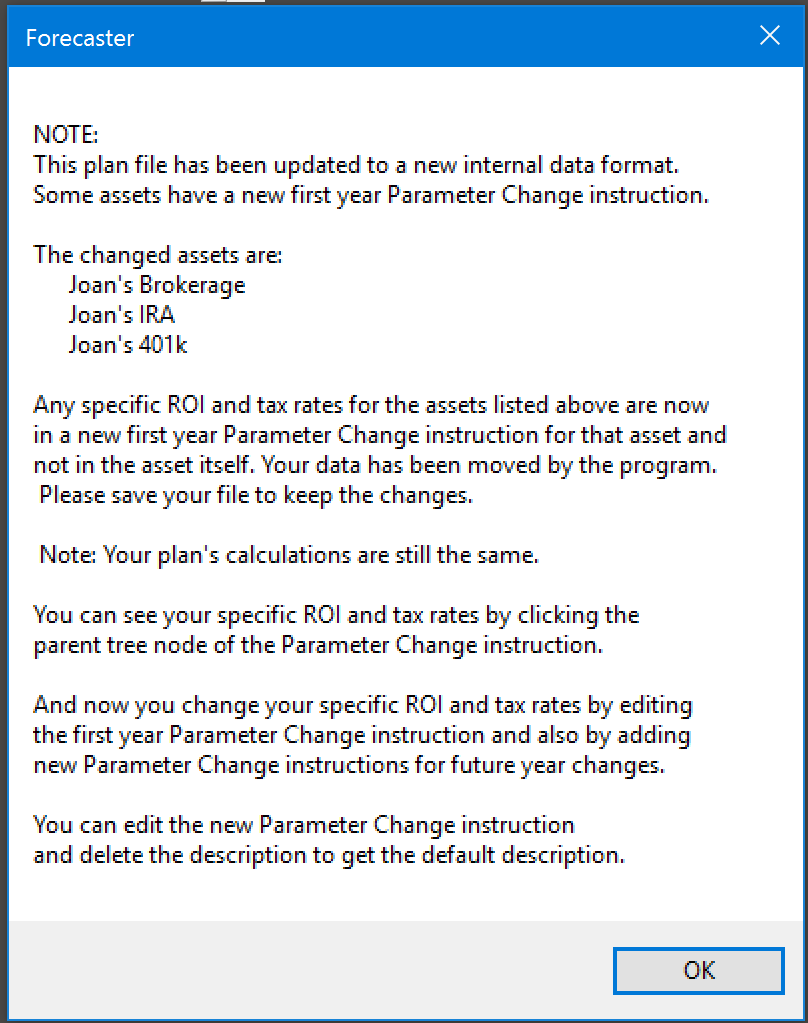

Assets in a plan created by the version 3 program may have had specific parameter data defined, such as a Roi rate or tax rates, to override the global rates. In the new version 4 program, asset parameters for these rates cannot be specified in the definition of the asset. Instead these specific values are specified by adding a Parameter Change instruction for the asset which is effective in the first plan year. This accomplishes the same result and is more in tune with the overall usage of Parameter Change instructions.

To accommodate old plan files in the new version 4 program, the old plan file's data is modified by Forcaster4 when it is first loaded. The specific parameters are deleted from the asset's definition, and a new Parameter Change instruction is created and added to the asset. This Parameter Change instruction is effective the first plan year and specifies the same parameter values that were in the asset's definition before.

A problem was discovered after the version 4.0.1 program was released. If a user wanted to update an old plan by changing the plan's start year from say 2014 to 2016, this caused an error which blocked the update. The program was checking to make sure that a Parameter Change instruction did not have an effective start that is earlier than the plan start. In this case that would have nullified any Parameter Change instruction that was added to substitute for the deleted asset parameter.

The fix is for the user to update any added Parameter Change instructions to the new effective start year first, then update the plan's start year. To assist the user, the version 4.0.2 program in this situation will alert the user to this problem by identifying the asset owning the Parameter Change instruction and suggesting a change there be done first.

Also the version 4.0.1 release had a bug in that it did not recognize specific parameter rates that were set to zero, and they were not assigned a new Parameter Change instruction for the asset. This has been fixed.

Other Fixes

Fixed income tax result of IRA bequest to spouse's non-ira account. This bequest causes the account's funds to be withdrawn, triggering a tax consequence. The income tax due is deducted from the funds.

Government Tax Laws

References to the Bush tax laws have been removed from the sample files. Any Bush tax law parameters are ignored and can be removed from your plans. The American Taxpayer Relief Act passed in 2013 has changed the tax laws followed by the Forecaster4 program. Listed below are the tax law items now used in your plan by default:

- The high end long term capital gains tax rate (currently 20% for 2016)

- The individual yearly gift tax exclusion (currently $14,000 for 2016)

- The unified credit tax exemption (currently $5,450,000 for 2016)

- The excess estate tax rate (currently 40% for 2016)

- The excess gift tax rate (currently 55% for 2016)

You can change these tax law items to your own preferred values. You can change these items to have your values be effective at any year of your plan, including the plan's start year. You do this by using a Parameter Change instruction to edit the global Plan Parameters and enter your preferred values to be in effect from the year of your choice. You can use a Parameter Change instruction to set a different value on any item in any year to respond to a change by Congress.

The high end long term capital gains tax rate is used by default. When calculating a long term capital gains tax amount, it is not possible for the Forecaster program to know your tax bracket in order to select the correct tax rate, so the current high end tax rate is used. You can override this by using a Parameter Change instruction on any individual asset or on the global parameters if another rate is more appropriate, or if the rate is changed in subsequent years by Congress.

Other tax law items used by default include: The individual yearly gift tax exclusion and the "unified credit" amount which is the total exclusion for lifetime gift tax and estate tax combined. The $5.45 million exemption applies to gift and estate taxes combined. Any exemption used for gifting will reduce the amount you can use for the estate tax.

These two exclusions can change yearly to account for inflation and also can be changed in subsequent years by Congress. You can use a Parameter Change instruction to set a different value on either in any year that they are changed by Congress. You can also set an annual indexing rate to try to match the yearly adjustments made by the IRS.

And two more tax law rates used by default are: the excess estate tax rate and the excess gift tax rate. You can override them by using a Parameter Change instruction to set a different value on either rate in any year that they are changed by Congress.

Please click the Help tab on the first two Global Plan Parameters data entry forms to see a more complete explanation.

Gift Taxes

Two principals are considered spouses. Gifts to spouses are tax free but any transfer from a principal to a non-principal is considered a gift and subject to tax.

In determining the yearly gift amounts by principals, all combinations of possible gift giving are considered: from joint account to individual, from joint account to joint account, from individual to individual, and from individual to joint account. If the gifts are to a life insurance trust, each beneficiary is considered an individual recipient. In each case the appropriate allocations of gift amounts are made as separate entries in the principal's records for individual comparisons with the Individual Yearly Gift Tax Exclusion.

The Forecaster4 program is opinionated about how gift tax rules are applied. For cases where yearly gifting exceeds individual yearly limits, the tax law's Unified Credit Tax Exemption is used to shield gifts from taxation. This uses up the Exemption before estate taxes are determined. The higher rate on your excess gifts is shielded before your excess estate amounts which are taxed at a lower rate.

At year end gifts by a principal to other persons are each individually compared to the current Individual Yearly Gift Tax Exclusion. If less, no action is taken. If more, the excess is shielded by the principal's Unified Credit Tax Exemption. The remaining balance of the Exemption is reduced by the amount shielded. If the remaining balance of the Unified Credit Tax Exemption goes to zero, the excess gift amount is taxed that year at the current Excess Gift Tax Rate. And the excess gift tax amount is collected and paid at year end from the plan's available accounts.

At the death of the first spouse, any remaining balance of the Unified Credit Tax Exemption is portable to the other spouse. All excess gift taxes have been paid in the year they occurred.

Estate Taxes

In 2016 married couples have a maximum federal exemption amount of twice the Unified Credit Tax Exemption due to the Exemption being portable. Upon the first spouse's death, any unused Exemption will be transferred to the surviving spouse and added to that spouse's current Unified Credit Tax Exemption remaining amount.

For purposes of this program, a principal's IRA balance at death is considered to be a part of their estate balance and subject to both income tax and estate tax.

At a principal's death, the total estate of the principal is determined. If it is more than the principal's current Unified Credit Tax Exemption, which could include a portable balance provided by a prior deceased spouse, the excess is taxed at the current Excess Estate Tax Rate.

(See: www.schwab.com/public/schwab/nn/articles/The-Estate-Tax-and-Lifetime-Gifting)

IRA Minimum Required Distributions

The life expectancy table data was updated to match the 2014 IRS tables, possibly affecting the RMDs from your IRAs. And the program's internal logic of categorizing an IRA beneficiary was changed in accordance with the IRS rules which could affect your plan's IRA beneficiaries that are relatives but not your spouse.

Indexed Instructions

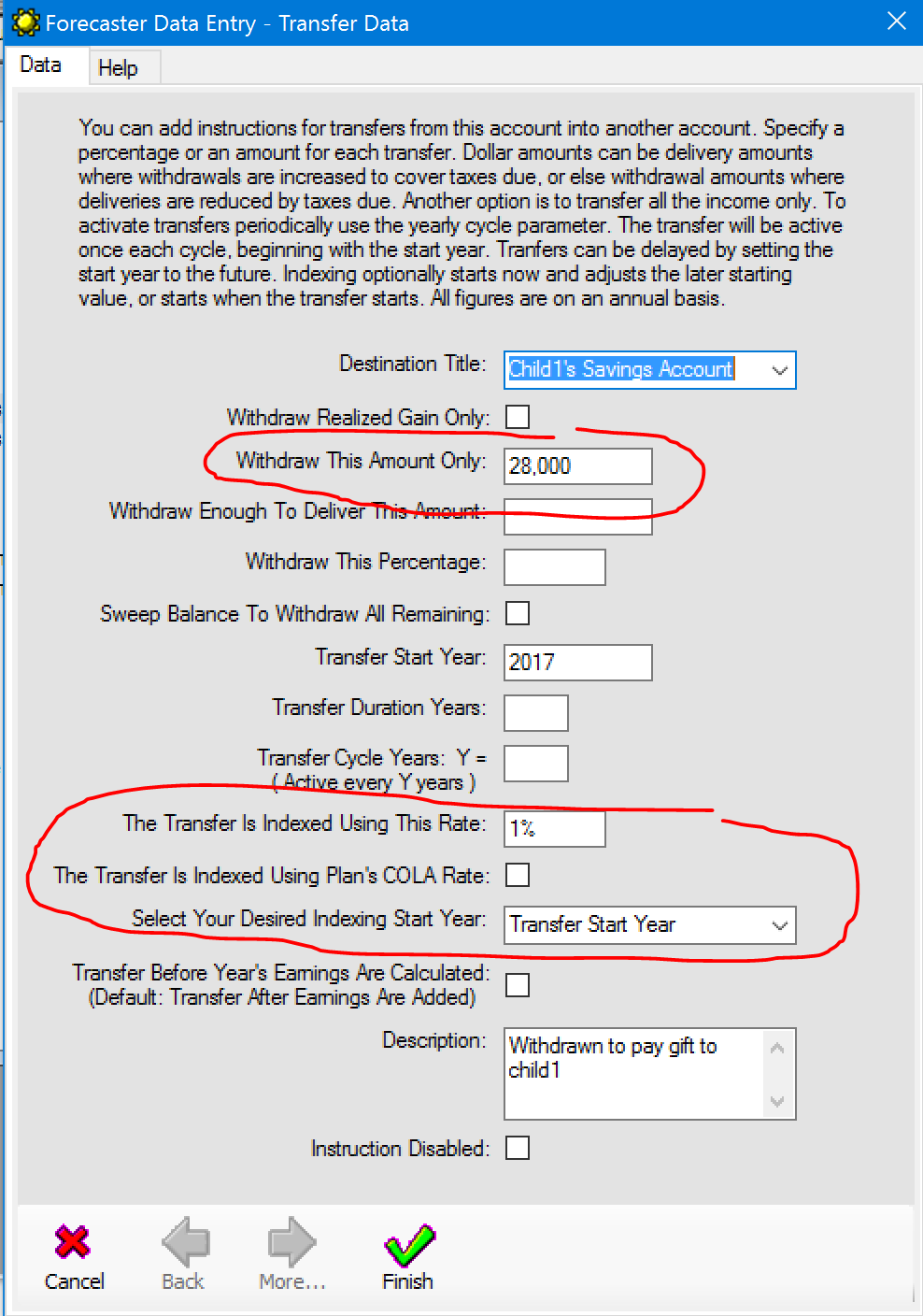

If an instruction has a specified amount expressed as a dollar value, not as a percentage, or a realized gain, or sweep balance, etc., then that amount is expressed in today's dollars and can be indexed for inflation to adjust the amount each year. When the instruction is indexed there are two options for when the indexing starts. Indexing can start from the plan's calculation start year or start when the instruction starts. Choosing to start indexing at the start year even if the instruction is delayed means the instruction's amount is inflation adjusted when the instruction starts.

Asset instructions can be delayed by setting the start year to the future. A delayed instruction's amount can be indexed to account for inflation if the instruction is indexed from the plan's start year. The later starting value will be inflation adjusted when first used, and then continues to be adjusted yearly. Or indexing can be delayed to start when the delayed instruction starts. This second option is the default for existing plans so as not to change calculation results for instructions already indexed in the old version.

This indexing for asset instructions is optional. If selected, indexing uses either a specific rate provided by you, or it uses the year's currently effective COLA parameter as defined in the global Plan Parameters and its Parameter Change instructions. Note that when running the Monte Carlo simulation trials, only ROI and COLA rates are varied by the specifed deviations, and any indexing rates with specific rates set by you will remain constant by default, unless you specifically request in the Monte Carlo data entry page that they also be varied by the same deviation as COLA.

Note: By design, indexing of instructions is not allowed for IRAs since changing your account amounts using indexed instructions in IRAs can have unintended tax consequences, not properly handled by the program.

An example of a transfer instruction being indexed is shown below. When editing instructions, click the Help tab at the top to see revised and updated documentation.

Example of a transfer instruction being indexed.

Note: The "Help" tab shows documentation in context for the current action and has been updated with the latest information. Click it in all the forms and windows.

The start of your retirement's living expenses payout can be some years later than the plan's calculation start year. This delayed payable amount is specified in today's dollars, and is always indexed by COLA beginning from the plan's calculation start year so as to be inflation adjusted when first used at the start of your retirement, and it is continually adjusted yearly.

A Parameter Change instruction can change retirement living expenses by a specified +/- amount at a future year. This is a deferred amount specified in today's dollars, and has been inflation adjusted by COLA when it is applied to your living expenses payout amount. Your new living expenses payout amount then continues to be adjusted yearly.

Parameter Change Instructions

Parameter Change Instructions let you change certain parameters at specified years during you plan's calculations. Any change specified by a Parameter Change instruction starts in its effective year and stays in effect until overridden by another Parameter Change instruction for a later year.

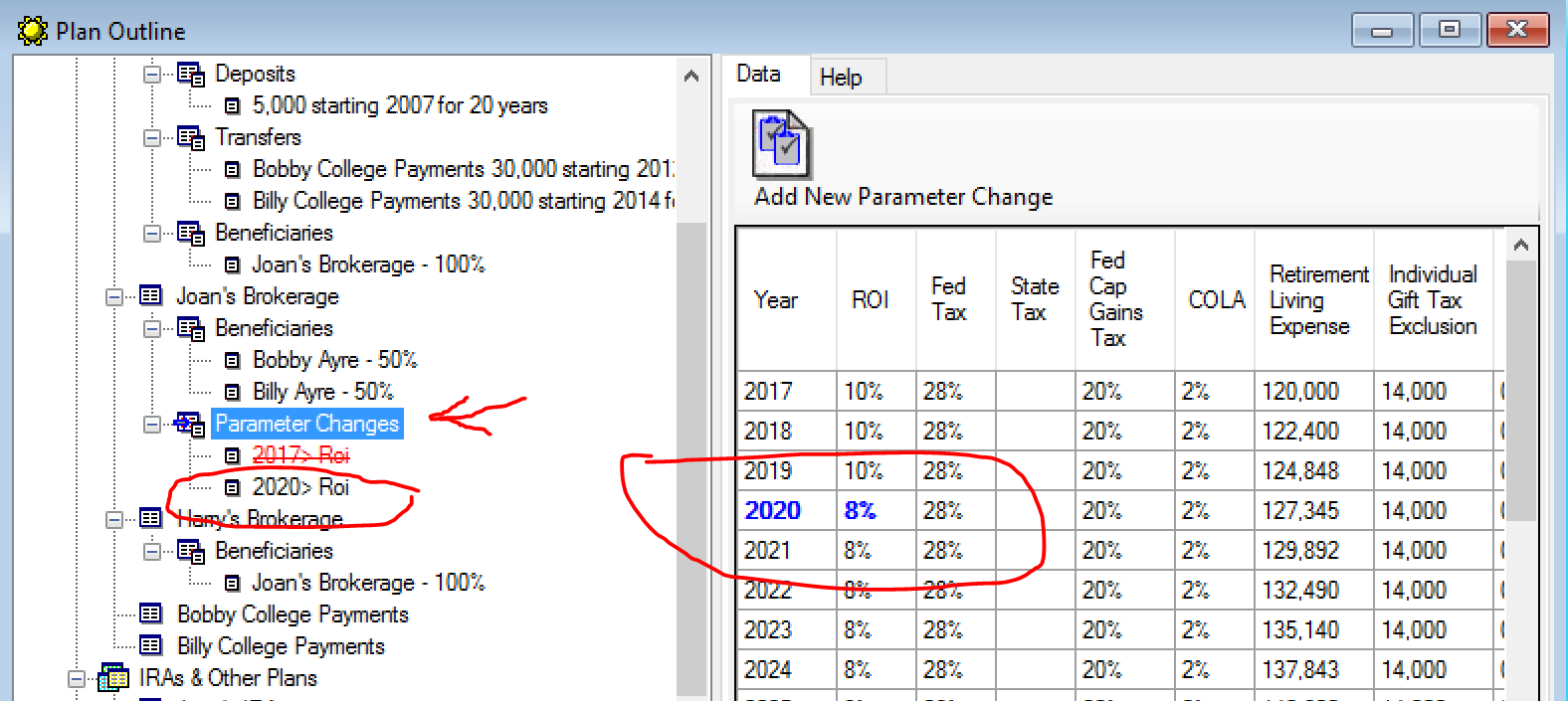

The tree view chart now displays complete Parameter Change data by left clicking an item's Parameter Changes parent tree node, not by right clicking as before. Clicking the Parameter Changes parent tree node shows a table of all the parameters used year-by-year in calculations for this account. The new display table identifies the specific changes resulting from the item's own instructions in blue text. These override the same global parameters. Click the Help tab on the resulting table display for more information.

In the figure above, Joan's Brokerage has applied a Parameter Change in 2020 to set the ROI to 8%. A click on the Parameter Change leaf in the outline tree shows all the Global Parameters that affect calculations for Joan's Brokerage. The local change just for Joan's Brokerage is shown in blue. Note that the Parameter Change for 2017 has been disabled and does not show. It can be quickly enabled by double clicking.

Note: Parameter Change instructions can change the program's tax law parameters: CapitalGainsTax, IndividualYearlyGiftTaxExclusion, UnifiedCreditTaxExemption, ExcessEstateTaxRate, and ExcessGiftTaxRate during the plan years in the global parameters.

In addition, indexing can be applied to the IndividualYearlyGiftTaxExclusion and the UnifiedCreditTaxExemption in the global parameters. But note that indexing the IndividualYearlyGiftTaxExclusion only triggers changes in $1,000 increments, following the government's procedure.

Monte Carlo Calculation Change

At the start of each trial in the Monte Carlo simulation, a random value for the calculation's ROI value and COLA value is obtained from a normal distribution as defined by your specifications of the standard deviations. This is done once at the start of each trial, and this same deviation is used throughout on every year of that trial. So the random ROI and COLA remain the same for the whole trial, unless they are changed in some year by a Parameter Change instruction. In that case the changed value is modified to have the same deviation, resulting in a corresponding new value to be used for that year and subsequent years.

The old way was different. The old logic used the normal distribution to obtain a new value each time the calculation called for the use of a ROI or COLA value. The objective in this new way is to not have discontinuous jumps in the calculation's ROI and COLA values each year from using different random variables throughout the year. These potentially significant swings in the space of a single year don't agree well with the trends of real life.

At the end of the Monte Carlo simulation, any trial run that was not able to finish with some remaining net worth will have written a record of the trial to the error file: "ForecasterErrorLog.txt". This record will include the ROI and COLA used as adjusted by the deviations specified. An example of a trial record will look like this:

- Monte Carlo Trial 91:

- TheAdjustedRoi = 9.8%, TheAdjustedCola = 4.2%:

- 2033: Calculations for "Calculation Result" had problems:

- Unable to provide required payout of 126,781 in 2033. Only 63,945 available.

Forecaster4 Plan Files

Forecaster4 plan files have a new file format to include data for new version 4 features. When you open a plan that was created by the prior version 3 program, the version 4 program will modify that old plan to the new plan file format.

If these automatic modifications concern you at all, please make a backup copy of your old plan before opening it in the new program.

The new version 4 program is following the 2013 American Taxpayer Relief Act instead of the old Bush era tax laws, so Bush tax law parameters are removed and parameters for the 2013 tax laws are added. Any plan Global Plan Parameters' Descriptions that reference Bush era items are removed.

The initial specification of a plan asset is no longer allowed to include a specific earnings rate, specific standard deviation, or specific tax rates. Instead a Parameter Change instruction, which overrides the Global Plan Parameters, is used for the first plan year to accomplish this same result.

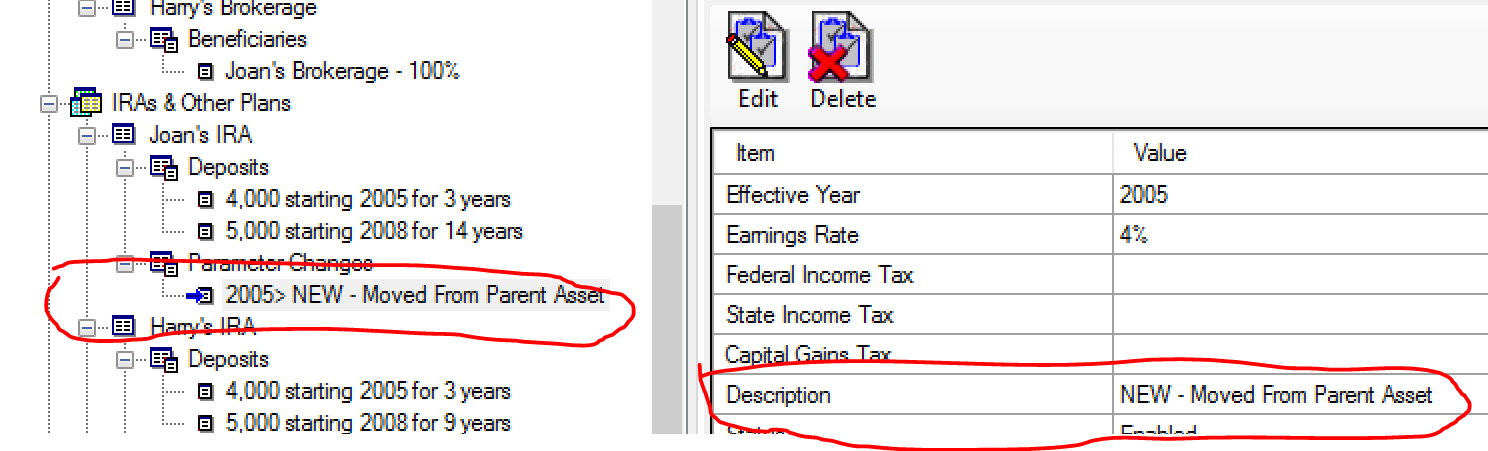

If an old plan file has assets with these initial specifications, the plan file will be modified to conform to this new usage. The initial specification will be removed and a Parameter Change instruction will be created and appended to the asset.

This change will be alerted to you by a popup message window as shown below. The new Parameter Change instruction will be visible on the plan's outline chart as can be seen below.

Edit the new Parameter Change instruction and delete the description to get the default description.

Sample Files

A group of sample plan files are installed along with the Forecaster4 program file. If you uninstall the Forecaster4 program, the sample plan files are uninstalled also.

The sample plan files are installed in the user's Local Application Data folder. For example: C:/Users/*username*/AppData/Local/Forecaster/Samples

The sample plan file names start with "sample-" to distinguish them from the sample files that were installed by the previous Forecaster3 version; those old files have names starting with "example-".

You can modify a sample plan to use for your own plan. But you are not allowed to save it using the same file name. Use the Save As… menu action to save it to your own folder using a new name.

Note: Some sample plan files may look strange to you since they don't seem to be correctly simulating an expected estate planning strategy. That's because they are used by me to test the code processing transactions using the government's gift and estate laws. I have set the global parameters to simplify most calculation actions and I have set the money values high to test the edge cases of the tax law exclusions and exemptions.

Another sample plan is designed specifically to test the use of indexed instructions. If you are interested in these details, you can use the "Tools/Request Trace..." facility to see traces of the transactions done while executing these plans. These files include:

- "estate plan gifting - joint to two"

- "insurance 2nd to die trust"

- "excess gifting"

- "indexed instructions"

Error Log Files

If a calculation of a plan has an error, an entry is written to the Error Log File. This is addition to the popup message box that alerts you to the error. This file is available for viewing and or printing by selecting the "Tools/View Error Log File" menu item.

When you run a Monte Carlo simulation, an error may occur during any one of the trial runs. These errors are not reported via a popup message box. But if they occur, they are also available for viewing and or printing via the Tools/View Error Log File menu.

What Else was Done

The Plan Overall Results window has been reworked to better present the plan's end results. The Pie Chart and the Estate Planning Results table now focus on the payments made outside the estate and the remaining residual amount:

- Total bequests delivered to recipients

- Lifetime gifts made to recipients

- Total gifts made for life insurance premiums

- Total payouts from life insurance to recipients

- Total estate taxes and withdrawal (income and penalty) taxes

- Residual estate after all payouts to recipients and taxes

The Pie Chart's slices may be different than your old results. Your resulting values may be different due to the new estate and gift tax laws plus the unified credit tax exemption, and how they are applied to your plan. Use the Tools/Request Trace selection to see more detail for any selected year's transactions. Choose the year of the "Summary Of Overall Estate Results" to see the estate's accounting at plan end.

When sample files are loaded they now have their plan's date values adjusted (time shifted) so as to appear as if they were created currently, not some years ago. Any reference to Bush tax laws in the description field is removed and the field is set to blank.

A double click on instructions now updates the Grid display immediately to show the resulting enabled/disabled status of the instruction.

The Withdrawal Decision Rules feature is removed, as it never worked as expected and is considered a failed experiment.

The "Specific Earnings Standard Deviation" parameter for assets is removed as it was an ill-founded attempt to achieve precision where in fact there is low accuracy due to the uncertainty in forward-looking projections based upon initial assumptions and the compounded uncertainties of future earnings, inflation and tax consequences.

Fixed a bug in File/Export To Excel to correctly send a plan's instruction data to an Excel work sheet. Fixed File/Print menu selection to correctly print global parameter change instructions. Fixed bug that did not recognize the disabled status of a beneficiary instruction. Fixed bug where MRDs from IRAs did not account for earlier specified withdrawals and then adjust the MRD amount lower.

Version 3 is Replaced by Version 4 - April 6, 2016

Updated to reflect the 2010 Tax Relief Act.

The 2010 Tax Relief Act includes a two-year extension of the Bush-era tax cuts, and restoration of the estate tax for individuals with estates in excess of $5 million, plus several other tax breaks that do not affect Forecaster's programming.

The ordinary income tax rates remain the same as they were in 2010 for two years, 2011 and 2012. The highest ordinary income tax rate continues to be 35 percent and both the capital gains rate and dividend rate continue to be 15 percent. If Congress had not agreed on legislation prior to the end of 2010, the highest ordinary income tax rate would have increased to 39.6 percent, the capital gains rate would have increased to 20 percent, and the dividend rate would have increased to 39.6 percent.

The estate tax exemption amount is increased to $5 million per person or $10 million per couple. Additionally, the gift tax exemption amount and the generation-skipping transfer tax exemption is increased to $5 million and unified with the estate tax exemption. The Act also changes the estate tax to allow the $5 million exemption to be portable, meaning the surviving spouse can use the unused estate tax exemption of their deceased spouse. The top tax rate is 35 percent for estate, gift and generation-skipping transfer tax. The changes to estate and gift tax under the Act will be effective for two years, 2011 and 2012.

Please note that the 2010 Tax Relief Act provides that provisions of the Act do not apply after December 31, 2012. In other words, the Tax Relief Act of 2001 is rescinded in 2013.

This program assumes these provisions are reenacted by a future Congress and are not rescinded in 2013. But the program provides an option for you to change this default and to assume that the tax bill sunsets and rescinds the new provisions in 2013.

Changed to a new Windows installer program.

A new Windows installation program is being used for version 3.0.66, therefore the new installer will not recognize the presence of version 3.0.65 or any older version to remove it. So after installing version 3.0.66, you should go to "Control Panel" --> "Add or Remove Programs" and remove version 3.0.65 or any older version yourself to avoid confusion with version 3.0.66.

Removing version 3.0.65 or older will also delete the old "My Documents\Forecaster Examples" folder. If you modified one of the plan files in there for your own use, please rename it and move it to another folder.

The new version 3.0.66 renames the program file to "Forecaster.exe", from "Forecaster3.exe", and uses a new icon to distinguish itself. It also uses a new "My Documents\Forecaster Example Plans" folder. If you modify one of these example Forecaster plan files for your own use, please rename it and move it to another folder.

Transfers from a traditional IRA to a Roth IRA will not have a penalty tax.

Usually there is a 10% early withdrawal penalty when funds are withdrawn from an IRA before age 59 1/2, but the Roth conversion is an exception. IRA funds withdrawn at any age are not subject to the 10% penalty if those funds are converted to a Roth IRA.

Tax Payments For IRA Distributions Obtained From ShortFall Accounts

When you specify that the tax payments for transfers (distributions) from IRAs are to be paid from a specified account, there is a possibility that the account does not have enough money. In this case, the balance of the tax due (the shortfall) will be collected from your plan's shortfall sources according to their rank sequence.

Click HERE for the shortfall rank sequence Help Page.

Tax Payments For IRA Distributions Specified In Transfer Instruction

The data entry wizard for a transfer instruction from a traditional IRA now includes a second screen where tax handling parameters can be defined. This screen was removed from the Roth IRA account data entry wizard. Old plan files with existing tax parameters for an IRA rollover conversion to a Roth are automatically updated when loaded.

IRA transfer to Roth no longer require zero balance for the conversion tax logic to work. Conversion tax logic now works on funded Roth accounts, and the transfer instruction itself from a traditional IRA includes the tax parameters.

For more information about this, browse to the IRA help page and scroll to the bottom section named "Tax Payments For IRA Distributions".

Click HERE for the IRA Help Page.

Faster A/B Testing

Double click on instructions now can be used to toggle between disabled states for faster

what-if testing of A/B comparisons.

More Support For Withdrawal Decision Rules

Finished printer output and the Export To Excel support for the new Withdrawal Decision Rules charts and tables. Added the Withdrawal Decision Rules data entry screen as last one in the Global Parameter data entry wizard.

2009 Required Minimum Distributions From IRAs Are Waived

Special Rule for 2009: The Worker, Retiree, and Employer Recovery Act of 2008 was signed into law by the President on December 23, 2008. The Act waives 2009 Required Minimum Distributions (RMDs) from Individual Retirement Arrangements (IRAs), and 401(k) retirement plans. The Forecaster program will no longer automatically perform this distribution for 2009.

Release Of Withdrawal Decision Rules Simulation

Withdrawal decision rules provide parameters for changing the withdrawal rates that affect living expense funding during retirement years. The Forecaster program now provides a way to use these rules to find a strategy to follow for achieving the best outcome. A new Knowledge Base page is added to the Web site and tutorial videos are provided.

NOTE: This release of the withdrawal decision rules simulation is an early release to allow for beta testing. As such, please report any errors so that they can be fixed. The parts of the release dealing with the simulation's calculations and reporting are done, but the print to hard copy and the export to Excel are not yet implemented.

Bug Fix

Stopped trying to use unmanaged code to center the SaveFile dialog in center of parent window - this sometimes caused an exception.

Change Made To Random ROI For Monte Carlo Simulations

A change was made to the Return On Investment (ROI) random number generator to always return zero when the plan's mean ROI is specified as zero, regardless of the specified Standard Deviation (SD) value. This allows a parameter change instruction to set ROI to zero for special Monte Carlo testing. To use the specified SD and get variations of ROI around zero, use a small mean value for ROI such as ROI = 0.01.

Changes Made To Accounting At The Year Of Death Of A Principal

A change was made in the plan's accounting when a principal dies. Now the death is assumed to be at the end of the death year. A principal's accounts now remain active for the balance of that year. Yearly transactions against the accounts owned by the principal now remain active and continue to take place in the year of death. Bequests to beneficiaries from investment accounts, life insurances, and living trusts now take place the following year.

This means that pension payments are still received, investment earnings are still added, required IRA distributions are still done. withdrawals are still taken, and taxes are still paid. These changes will change the year-end balance for the principal's accounts from what they were before.

Also, at the death of the last principal, retirement living expenses are still paid out in the year of death. This change will change the reported estate value.

This change was made to streamline the internal accounting logic. I think the result more accurately models the real world in most cases. Also, the chart lines no longer have a discontinuity at the last year.

The prior accounting treatment was to stop transactions in the year of death and do bequests to beneficiaries from assets that same year.

Changes Made To Social Security Tax Calculation

A change was made to obtain a ball park estimate of personal income at the start of each year's calculations, so that its effect on the income tax due on any Social Security payment could be modeled. This may change your plan's year ending balances.

Miscellaneous Bug Fixes

Fixed a bug in IRA to Roth conversion transfer. If the specified tax payment source account can't cover full tax due, the balance is now taken from the IRA funds transferred.

Fixed a bug that calculated the wrong withdrawal amount needed from an IRA, in order to satisfy a retirement expense shortfall amount after taxes, if you were subject to a penalty tax for the withdrawal.

Fixed a bug that sometimes caused a program exception while ranking accounts for shortfall withdrawals.

The transaction journal reports and the estate planning results reports have been fixed to correct some small errors in layout and content.

Changes Made To Allow Entry Of An Initial Value Lower Than The Cost Basis

If you were revising your Forecaster plan to reflect current conditions (bear market), you may have run into a problem. The values you may have wanted to enter for an IRA account were not allowed, and were reported as an error since your initial value (current balance) was less than your cost basis (ouch). So changes were made to allow the entry of those values (after warning you of a possible mistake).

Changes To Long-Term Capital Gain Accounts

Now a long-term capital gain account allows you to define parameters for yearly distributions. You can define what part of the yearly investment gain is a distributed realized gain. Parameters can be defined to apportion the realized gain into parts corresponding to qualified dividend income, long-term gain income, tax-free income, and ordinary income. The appropriate taxes are charged to each part. The resulting after-tax income can be keep in the account with an increase in the adjusted cost basis, or it can be removed through the use of withdrawal instructions or transfer instructions.

Before, the entire yearly gain was retained in the account. There was no provision for yearly distributions, or for tax treatment other than long-term capital gain.

Also, an error in the effective long-term capital gain tax rate has been corrected. Before, the state income tax was not considered. If your account is subject to a specified state income tax, the effective long-term capital gains tax may be more than before, as the total tax rate is the sum of the two (a state's capital gains tax rate is usually the same as its ordinary income tax rate), and this was not done correctly in all cases before.

You can set the specific state income tax in your capital gains account to whatever rate you want to control the effective long-term capital gains tax rate. But the outcome may be wrong tax wise.

Source Ranking For Shortfall Payouts

There is now an improved capability for a user to specify the sequence of accounts for withdrawals to make up expense funding shortfalls. It's called "Asset Account Ranking For Shortfall Withdrawal Sequence", or Source Ranking for short.

Periodically Active Instructions

You can now specify that a cost instruction or transfer instruction be active only periodically, skipping years, by specifying a yearly cycle parameter. The cost instruction or transfer instruction will be active once each cycle, beginning with the start year.

Cost Instructions

The restrictions on the use of cost instructions (as detailed in the version notes for March 4th this year) have been relaxed to allow cost instructions to be specified both before and during retirement. Before retirement, the sum of all costs becomes the year's only expense amount.

Eligible accounts will be accessed in either a default or assigned sequence as specified by you to fund these costs, even before retirement.

Click HERE for the Help Page. .

Higher Tax On Long Term Capital Gains Accounts

You may notice an increase in the tax on withdrawals from long term capital gains accounts. This is because I did not program the tax calculation correctly. I only used the single long term tax parameter, either the plan's internal rate, or as specified in your data entry forms. But most states treat capital gains as ordinary income, and so it is also taxed at the normal state income tax rates. So I am adding the state tax rate to the capital gains tax rate resulting in a higher tax. Of course you can specify the state income tax rate on each specific account to set this at any rate you desire for your plan.

Maintenance Release

If you were running a program like PrintKey or Snagit which is used to capture screen images, then there was a conflict with Forecaster's print function which caused Forecaster to crash. The problem was that we all tried to use the clipboard at the same time, and Forecaster was the loser. Forecaster has been changed to bypass this problem. Some other small fixes are also included.

Cost Basis For IRA Accounts

You can specify that a traditional IRA account have a cost basis that has been established by after-tax contributions. Future distributions of the cost basis amount are tax- and penalty-free. Deposit instructions for traditional IRA accounts can be specified as an after-tax contribution so as to increase (or create) a cost basis.

Parameter Change Instructions

A new feature is added to Forecaster that allows you to specify a parameter change that is effective starting at a particular year. The new item, called a parameter change instruction, is added to the other instructions available for designing a plan. Parameter change instructions can be defined for each individual asset in your plan. And they can also be defined for the initial plan details that specify the plan's global parameters.

Each instruction specifies its effective year and then one or more parameter changes to be effective from that year onward. By specifying one or more of these instructions, for different years, you can create a plan with varying parameters over the years of the plan's calculations.

Calculation Results Can Be Different Now

If you have run calculations with Forecaster version 3.0.50 or earlier, there are several diferences in the program, made to support parameter changes, that can result is slightly different calculation results.

The yearly individual gift tax exclusion value is calculated differently now. For any year in your plan where gift taxes were due and calculated, the tax amount can be different.

The yearly-inflated value of your retirement expense is calculated differently now. The year-to-year value of this expense can be different.

A different method of determining a year's capital gains tax corrected an error found in the prior version. This can cause a different result.

Overall, the different results that have been observed are less than 1% (except for accounts with long term capital gains, because of the corrected tax error).

Drag And Drop To Re-Sequence The Plan's Execution Of Instructions

There is a new method of specifying the execution sequence of the plan's instructions. Instead of entering a priority number in the data entry form, the execution sequence is determined by the instruction's relative location in the tree view of the plan. The execution sequence of each account's instructions follows the location sequence of its instructions under the parent's node.

To change the execution sequence, you change the relative locations of instructions on the tree view. To do this you drag and drop a tree view node to a new position. You drop onto the node that is the one you want the dragged node to go behind. You can drop on the top node, the parent defining the items, in order to put the dropped node into first place. You can drop on the last node to put the dropped node into last place.

New Transfer Instruction Option

In some instances, you may want to specify a transfer from one account to another before the year's earnings are calculated and added to either account's balance. This would simulate a beginning-of-year as opposed to an end-of-year transfer. To accomplish this, a new check box is added in the Transfer instruction data entry form that says "Transfer Before Year's Earnings Are Calculated". If left unchecked, the transfer is done from the account after the earnings are added, as was done in earlier versions.

New Trace File

A new feature generates a trace file of transactions for a selected year. This can help you understand the data shown in the charts and tables after a calculation. To create this file, use the drop down "Request Trace..." menu item under the "Tools" menu. Enter the year you want to trace and click Ok. The next calculation run produces a log file of the transactions in chronological sequence, so that you can see the numbers that are used to create the charts and tables.

The file is created in the folder that holds the Forecaster.exe program file. It is named "ForecasterTrace-yyyy.txt", where yyyy is the year you entered in the Request Trace form. A trace request via this menu is good for one calculation run only. Repeat the request to get another trace.

To view the trace after a file has been created, use the drop down "View Last Trace" menu item under the "Tools" menu. This opens the trace file in the Windows NotePad program.

The trace file also can be created by adding this token as a command line argument: "/Tyyyy", where yyyy is the year you want to trace. This trace request stays active for the whole time the program is loaded. But it can be overridden on a one-time basis each time a request is entered via the "Tools" menu.

If you want the trace files created in a different folder, add this token as a command line argument: "/Fpath", where path is the path where you want the trace file created. Note that there is no space between "/F" and the path name in the tokens, even though the path name itself can contain spaces.

New Error Log File

When errors are detected during the calculation, they are no longer reported immediately with pop-up message windows. Instead each error is written to an error log file. At the end of the calculation, if errors were detected, a pop-up window alerts you and shows you a button to click to see the whole list of errors.

The error log file is created in the folder that holds the Forecaster.exe program file. It is named "ForecasterErrorLog.txt", This file is re-created each time you run a calculation.

To view the error log file after a file has been created, use the drop down "View Error Log File" menu item under the "Tools" menu. This opens the error log file in the Windows NotePad program.

Error Test For Incorrect Use Of Cost and Withdrawal Instructions

Additional tests and error messages were added to detect the improper use of withdrawal instructions or cost instructions before the retirement years.

A cost instruction for an account causes the retirement living expense amount to be increased by the cost amount so that the funds can be collected. The program adds the cost instruction amount to the inflation adjusted living expense amount. Then funds are collected for the total amount. The money for the specified cost is taken from this collected pool of funds and is moved to the account with the cost instruction. The remaining balance covers the year's retirement living expense.

Withdrawal instructions are used to specify a particular source and amount of money for retirement expenses. This money is to be obtained by the program before it uses its own logic to obtain the remaining balance of money required.

Neither withdrawal instructions nor cost instructions should be used for money movements before retirement. Before retirement, while you are still in the accumulation phase, money movements should be done by transfers and deposits only.

Error Tests For Money Movement Out Of Accounts

A change has been made to how the program handles instructions for money movement out of accounts. These instructions are withdrawals, transfers, and beneficiaries, Any sequence of multiple instructions of these types cannot, in total, ask for more than the total of the account balance. Before, a final instruction was allowed to ask for more than was available, and it got the remainder with no error. For more information, click here see an explaination of the NEW RULE

The old way mostly applied to money requests specified by percentages. The old way applied the specified percentage to the remaining account balance, after any prior instruction was handled. And a final 100% always got whatever remained. The new way applies each specified percentage to the beginning balance as it was at the start of the sequence of instructions. So a sequence of three transfer instructions for 33%, 50%, and 100% will now generate an error since the sequence is asking for more than 100% in total. (See example file: "example- 3 children as ira beneficiaries.frc")

There are situations that require moving a fixed amount and then trying to move the reminder. Take, for instance, a joint trust terminating after the first to die. The balance at that time depends on the earnings and taxes. The desired beneficiary payments are 1.000,000 to a family trust and any remaining balance to a martial deduction trust. For situations such as these, a new instruction parameter named "Sweep Balance" has been added. Specify this for the last instruction in a sequence when you want to move whatever balance remains, taking the final balance to zero. (See: example- estate planning with trusts.frc)

Use the new drag and drop capability to re-arrange the sequence of instructions to control the sequence of money movement.

First Year Earnings Not Prorated

Since version 3.0.0.47, the program prorated first year earnings according to the current computer date at the time of the calculation. This created a problem for users running repeated calculations on succeeding days. They saw discrepancies in the output numbers caused by the different fractions used to prorate the first year earnings.

This version does not prorate first year earnings. The program always calculates the full year's earnings assuming that the user has entered the appropriate (adjusted or approximated) number for the beginning balance of the first year.

Inflation Indexing Added To Instructions.

You can now specify indexing for deposit, transfer, cost, and withdrawal instructions. This allows these instructions to adjust the specified amounts each year by a rate you choose, so as to keep pace with inflation or with your earnings growth before retirement. These indexing rates are not varied during the Monte Carlo simulation.

During your earning years, you will fund your asset accounts by deposit instructions. The program now has an indexed deposit instruction to approximate the growth in your ability to accumulate capital during your earning years. Use more than one for different indexing rates over different periods.

While funding your asset accounts, you may wish to also fund some special purpose accounts, such as accounts earmarked for your children's upbringing and college tuition. The program now has indexed transfer instructions to fund these kinds of special purpose accounts over the period of your earning years, while accounting for inflation. Use more than one for different indexing over different periods. See the example plan file "example-indexed instructions.frc",

During your retirement years, while drawing from your assets to fund your living expenses, you may wish to fund some special purpose account, such as a grandchild's college tuition or an around-the-world vacation. This expense is finished after a short duration; it does not last for your entire retirement so cannot be added into your estimate of retirement living expenses. Set up a separate account which is specified as "Total Balance Is Used Up Yearly", and which has a cost instruction for the duration of the expense to satisfy this planning objective. And the cost instruction now can be indexed to keep pace with inflation over its life.

During your retirement years, the Forecaster program draws money from your eligible assets to fund your living expenses. The sequence of accounts it draws from is specified in the plan parameters as either the plan's default or as specified by you. In addition, you may specify a particular source account and amount through a withdrawal instruction. Now this instruction can be indexed if desired.

New Example Plan File For Indexed Instructions

The example plan file "example- indexed instructions.frc" shows how indexed instructions are used in both the accumulation phase and the retirement phase of your plan.

During accumulation in the example plan, there are two children, both of whom have a special purpose expense/college account. There are two transfer instructions for each special purpose expense/college account. One is indexed at a beginning rate up to age 17; the other is indexed at the accepted college expenses rate. The two expense/college accounts are specified as "Withdrawals Only As Specified", so they are not eligible to be tapped for your retirement, if they exist that long.

There is no need to model the disbursements from these accounts; you are only interested in providing for the funding. But there is a dummy account added in the example plan file to take the final total amounts out of those accounts so that they won't show up in your estate when you die.

During retirement in the example plan, there are two special purpose accounts. One to provide funds for a grandchild's college expenses. Another to provide funds for a special vacation. There are indexed cost instructions for both these accounts to demonstrate the concept. Both of these accounts are specified as "Total Balance Is Used Up Yearly" so the account balance goes to zero each year.

There is no need for you to see an increasing total balance from yearly payments into these accounts. You only need to model the outgoing payments and their effect on your retirement funds.

Changes To The Deployment Method

Starting with this version, all new version updates will be deployed by a new method. Unfortunately, the new method does not know about the old method and cannot uninstall the old version, so the old version installation will remain on your computer. You have to remove it yourself to uninstall it. The Web site will guide you through these steps when the time comes. There is no harm in having both installations present on your computer, just some possible confusion since they are both named Forecaster3, and there are two entries in the All Programs menu, one for each.

The new deployment method installs a few program files, along with some example plan files, into a folder of your choice. The new version will only work if you have Microsoft's .NET Framework version 2.0 (or later) installed. If you are using an IE browser, then this Web site can detect if you have .NET 2 or not, and can direct you to Microsoft's site to download and install it if necessary. If you are using another browser, you will have to verify this yourself.

This new method uses Isolated Applications and Side-by-side Assemblies, which is a Microsoft Windows solution that reduces versioning conflicts in Windows applications. A technical explanation is available at http://msdn2.microsoft.com/en-gb/library/aa375193.aspx.

Internal Housekeeping Change

Changes were made to prepare for a new method of deployment and installation. The version number format was changed from "x.x.x.x" to "x.x.x".

For the first year since its release, Forecaster deployment was done using the Net2 framework ClickOnce function. It worked fine for the first year, then I found out that the ClickOnce security certificates only last 1 year. These are apparently considered to be test certificates for use only while developing new programs. This fact was not known by me, and I was blindsided when my certificate stopped working. Permanent ones have to be purchased at $200/year. I found out how to create a new "test" certificate, but then was told that "changing the certificate will change the identity of the ClickOnce application, so updates will stop working on previously installed application." That was a bummer as I had already published the latest revision using the new certificate.

Unnecessary Journal Entries Eliminated

Unnecessary journal entries for zero gift taxes were a result of some programming logic that could have been done better. This has been fixed. Note that the calculations were not incorrect, just that the journal entries were confusing.

Prorated Earnings For First Year Calculation

Before, earnings were calculated as zero for the first year when the "Calculation Start Year" was the same as the year on the computer's clock, and the month was in the second half of the year. This has been changed so that prorated earnings are calculated based on the number of days left in the year. This procedure is based on the assumption that you have entered current account balance information before you run the program. Therefore your account balances already reflect earnings up to the current time, and the program should just add in a prorated amount to reflect the projected earnings remaining in the first year.

Early Distributions From IRAs Without Penalty Tax

To handle penalty free early withdrawals, a new check box has been added to "withdrawal" instructions and "transfer" instructions that are from IRA accounts. This gives you an option to define each specific distribution as one without penalty tax. In that way you can define your planned early distributions and have them done without a penalty tax calculation by the program. You have to specify each individual distribution and mark it as exempt from penalty tax. The Forecaster program does not verify the correctness of your specifications.

You can specify a series of Substantially Equal Periodic Payments (SEPP) based on the amount in the account and your life expectancy. This is called a Systematic Withdrawal Program (SWP). The IRS rules state the once you establish an early-distribution SWP schedule, you must stick to it for at least five years and until you are at least 59 1/2. You have to figure out your yearly distributions using the available tools and calculators (See http://www.dinkytown.net/java/Retire72T.html) and specify them individually year by year. The Forecaster program does not do this.

You can also specify a series of early IRA distribution instructions used for "qualified higher education expenses" for yourself, spouse, or your or your spouse's child or grandchild, which are exempt and are not penalized.

Also, an early IRA distribution by a qualified first-time home buyer can escape the penalty, but is limited to distributions totaling $10,000 during an individual's lifetime.

The Forecaster program will allow you to define specific withdrawal and transfer instructions from IRA accounts to simulate early distributions that are penalty free, You must define a separate instruction for each year's distribution. Each withdrawal or transfer instruction will specify the year of the distribution, the amount, and a period of one year. The check box labeled "Exempt From Penalty Tax" must be checked. If you use wrong dates or wrong amounts or wrong periods, there is no error message from the program.

Monies "transferred" from accounts are placed into the destination account, to be used according to the instructions for that destination account. Monies "withdrawn" from accounts are added directly to the collection of funds used to provide for the year's total retirement living expenses, thereby reducing the total needed to be acquired from any available account funds.

Remember: Any distributions prior to age 59 1/2 for educational or first-time home expenses, or under a SWP will always be subject to income tax under regular IRA tax rules, whether or not there is an early distribution penalty.

Changes To Processing Of Variable Annuities

This is how Forecaster now handles annuities. First, the annuity is declared as being a variable annuity or not. If it is not a variable annuity, it is assumed to be an immediate annuity.

Immediate annuities are defined with these specifications:

Purchase Price

Annuity Commencement (Annuitization) Date

Annuity Yearly Payout Amount

Annuity Benefit Type:

Single Life

Term Certain

Contingent

After the annuitization date, payments are made in accordance with the details entered for the annuity benefit type chosen. The insurance company will have provided the payout amount based on interest rates at the time of purchase.

Taxes are calculated as follows. Part of each payment is considered as a return of previously taxed principal (i.e., your purchase cost) and part as earnings. You will owe income taxes on the part of the payment that's considered earnings. The amount of each payment that won't be taxed is computed by establishing an "exclusion ratio" that's determined by dividing your purchase cost by the total amount you expect to receive during the payout period. In the case of a Single Life benefit, this period is assumed to be your life expectancy as specified in the plan.

Variable annuities are defined with these specifications:

Current Value Of Annuity Assets

Current Total Value Of Your Contributions

Annuity Annuitization Date (If Any)

Assumed Interest Rate At Annuitization

If the variable annuity is to be annuitized (a deferred annuity), the only type handled by the Forecaster program is a Single Life benefit. A deferred annuity has two phases, the accumulation phase and the distribution phase. During the accumulation phase, the annuity grows untaxed through the years as the investment compounds. In the distribution phase, the annuity benefit is paid out. Because of the complexities of determining the parameters of annuity benefit payments at that time, the program only handles Single Life benefit payments over your lifetime.

When the deferred annuity is annuitized, the yearly annuity payment is calculated using the total value of the variable annuity account, the estimated years left in your life as obtained from IRS life expectancy tables, and the assumed interest rate that you entered.

Taxes are calculated as follows for an annuitized deferred annuity. Part of each payment is considered as a return of previously taxed principal (i.e., your total contributions) and part as earnings. You will owe income taxes on the part of the payment that's considered earnings. The amount of each payment that won't be taxed is computed by establishing an excludable amount by dividing your total contribution by the period over which you will receive the annuity benefit payments. This period is assumed to be your life expectancy as specified in the plan.

If the variable annuity is never annuitized, you can continue to contribute and then withdraw on your own schedule. In this case taxes are calculated differently. Withdrawals are taxed on a last-in, first-out basis. That means for income tax purposes the first money out of the annuity will be considered as earnings, not principal, and will be taxed as ordinary income when withdrawn. Additionally, just like a traditional IRA, withdrawals made prior to age 59 1/2 are subject to a 10% early withdrawal penalty. When all earnings are withdrawn, the remaining amounts, which are your contributions, are not taxed on withdrawal. But new earnings occurring later will be taxed.

Annuities can override global parameters with these specifications:

Exceptions To Your Plan's Global Rates

Specific Earnings Rate (variable annuities only)

Specific Earnings Standard Deviation (variable annuities only)

Specific Income Tax Rate

Congress Passes Extension Of 2003 Tax Cuts

The May 2006 act extends the president's 2003 capital gains tax cuts to 2010, two years beyond their original expiration date. This program has incorporated appropriate provisions of the act, as extended. This program assumes these provisions are reenacted by a future Congress and are not rescinded in 2011, but in your plan you can change this assumption to test the effect of the provisions being rescinded.

Note that if your plan has changed this assumption, to test the effect of these provisions being rescinded, and you are using the default shortfall withdrawal sequence, that sequence may change because of the different tax liability of your accounts during the extra two years of tax cuts. You can check your withdrawal sequence in the second page of the parameters editing dialog.

Also, a link to the Web page with screen shots of Forecaster examples was added to the Help menu.

Deletion Of Plan Component Problem

During the programming for the version 3.0.0.41 speed up, a bug was introduced that prevented a user from deleting a plan component. This is now fixed.

New Plan's Quick Start Bug Fix

During the programming for the version 3.0.0.38 bug fix, another bug was introduced that prevented the tool bar icons for "Quick Start A Plan" and "Specify Plan Details" from appearing when a user clicked the "New" icon or File menu selection. This is now fixed.

Speed Up Of Calculation Time

The program was extensively reprogrammed to eliminate processing overhead when calculating the plan results. A significant improvement was obtained that is most noticeable in the Monte Carlo simulation runs.

A bug was fixed that prevented exporting to Excel if a plan component name was too long for an Excel worksheet name.

Cleaned up some small errors in handling the ranking of accounts for shortfall withdrawals.

Selection Of Printer

Changed the dialog box that defines the print request so that it includes an option to request a printer selection dialog first.

Save Plan Bug Fix

Fixed a bug which prevented one from saving a partially completed plan if parameters were not yet specified.

Changes To IRA Withdrawals

Added a parameter to the Person definition to specify that a principal is totally and permanently disabled. This lets Forecaster distribute funds from the person's IRA before age 59-1/2, if the funds are needed for retirement income, without any penalty tax.

Added a parameter to the IRA definition to allow withdrawal of funds from the IRA before the owner is 59-1/2, if the funds are needed for retirement income. This early distribution is subject to a penalty tax, unless the owner is totally and permanently disabled.

Use of .NET Framework XML Classes

Reprogrammed the XML based file data management routines to use the .NET Framework XML Classes instead of the MSXML DOMDocument COM interface. This removed the potential for run time errors that incorrect registrations of DLL modules created.

Release Of The New Forecaster Program And Web Site.

The Retirement Forecaster Web site is opened to allow the downloading of the Forecaster program, along with the prerequisite .NET 2 Framework software.

Several new example Forecaster plan files are placed in your "My Documents" folder as part of the installation.

The Web site supports an important feature of Microsoft's .NET 2 Framework. If you are connected to the Internet, automatic alerts and downloading for application updates are provided.

New Version Of The Retirement Forecaster Program.

This is a redesigned Forecaster program that is based on the November 2005 release of the new Microsoft development products: Visual Basic 2005 and the .NET 2 Framework.

The user interface is completely redone. It is now easier to use, and more information about the Forecaster plan is displayed in the Outline Window.

A new selection available when opening a new plan is the "Quick Start A Plan" option which leads you through a step by step sequence to quickly build a basic plan for your retirement forecast. This basic plan gets you started and can be expanded later to be more complex if that is needed.

You can enter a text description for the overall plan, and also for every item defined in the plan.

An additional way has been added to specify transfer instructions. There are some cases where the amount to be delivered to the recipient must be a fixed value, regardless of withdrawal taxes and/or gift taxes. For example when you are specifying a transfer to pay a life insurance premium (for estate planning), the required premium amount must be delivered regardless of any taxes that may occur. To cover this, the withdrawn amount is bumped up by the program to cover necessary taxes.

A fictitious "Third Party" owner has been added to the list of possible account/trust owners. This is so that you don't have to create a dummy irrevocable trust account just to hold ownership of life insurance for estate planning. The "Third Party" can be selected as an owner of the policy to take it out of the estate.

Gift taxes are handled more comprehensively. If you are gifting to a "Crummey Trust" to pay premiums for life insurance benefiting your heirs, then the gift is apportioned to the policy's beneficiaries according to their share, to determine gift tax consequences. (Any life insurance owned by the "Third Party" is assumed to be a Crummey trust arrangement set up by your estate planning advisor.)

A new plan file format is used. When opened in the version 3 program, an existing version 2 plan file is automatically converted to the new version 3 format, with a new file name extension of ".frc". The version 2 plan file is left unchanged with its ".for" extension.

If you are upgrading from the version 2 program, and you run a calculation on a converted plan file, you may find differences between the version 3 results and the version 2 results. Some of this is due to the programming language change which effects the rounding of the math results in the financial calculations. And some is due to revised algorithms used in determining results from various taxable events. These small changes accumulate over the life of the plan, but the net change is small and can be reasonably ignored when you consider the overall uncertainty of your assumptions and the large changes in outcomes that can result from small variances in these assumptions.

Bugfix Update.

Corrected an error which caused the program to abort when exporting to Excel.

Bugfix Update.

Corrected an error when calculating death benefits from a variable life insurance policy. This error changed the saved value of the policy's starting cash value to an incorrect number, so subsequent calculations were wrong.

Miscellaneous Updates.

Added logic to test if Microsoft's Windows Script Runtime is installed, and alert the user if it is not. This is required by Forecaster, but some older computers may not have it available. It is easily installed from the Microsoft Web site.

In the Outline window, the outline item for deposits, costs, and withdrawals has been changed so that it displays all the data entered. Instead of just the amount, the start date and the period are also shown.

The data entry window for deposits, costs, and withdrawals has a new text area where you can enter a description for your later reference. This text is not shown in the Outline, but it is maintained for subsequent display in the data entry window.

IRA-401k Distributions.

Fixed a problem in the correct calculation of taxes due on distributions from IRA-401k accounts when the account is changed from a traditional account to a Roth account and then back to a traditional account while doing what-if scenarios.

Indexed Pensions.

Fixed a problem in the Forecaster program that prevented proper handling of pension payments that are indexed for inflation.

Social Security Survivor Benefit.

Social Security survivor benefit percentage is a new data entry for Pension accounts.

The Social Security survivor benefit percentage enables the program to do automatic calculation of inflation-adjusted survivor benefits.

Reduction In Retirement Expenses.

When a principal dies, a reduction in retirement expenses may be effected.

The data entry form for Persons has a new data entry field for the principals. This allows you to specify a reduction in retirement expenses when the principal dies. The changed payout shows in the Retiree Payout column in the Combined Yearly Results window. It adjusts automatically for inflation. A new sample file "Reduced Survivor Expenses Retirement Example.for" is included in the upgrade and is placed in the Sample Files directory.

Export to Excel 97.

A problem that prevented exporting data to Excel 97 is fixed.

As detailed by Microsoft in their Knowledge Base Article 242375, an Automation client (like Forecaster) compiled with the Excel 2000 type library does not work with the Excel 97 application unless the program uses late binding instead of early binding. This has been done.

Entry Of Fractional Percent Data.

A bug in editing fractional percentage values has been corrected. Please check any fractional percentage values in your plans.

Other Income.

A bug that kept this feature from working correctly is fixed. Please check your plans that have Other Income specified.

Other Income

Changed the Pension account to include other income payments.

The Pension account has been changed to be more general in that you can now specify receipts of other income payments in addition to receipts of pension payments.

2003 Tax Act

Changed the Forecaster program to use the new rates on long-term capital gains.

This program assumes these provisions are reenacted by a future Congress and are not rescinded in 2008. But the program provides an option for you to change this default and to assume that the tax bill sunsets and rescinds the new provisions in 2008.

Long-term Assets

Changed the Forecaster program to correctly handle accounts that are long-term assets which have a cost basis and a long-term capital gains tax rate.

The installation of this new version also includes a new example forecast file "Longterm Capital Gains Example" that demonstrates the new program's operation. Open this example file to follow the instructions below.

Double-click on the Asset account "Long Term Investment" to open the edit window. The 1st data-entry screen of this window is the same as before.

Click the More button. The 2nd data-entry screen has a new option: "Tax Normal � Long Term Capital Gain". Selecting this option establishes a new type of asset account designed to handle long-term capital gain assets. This new type of account does not tax any growth in asset value (still called "earnings" in the results windows). Long-term capital gains taxes are collected from any money that is withdrawn from the account. Taxes are not collected from any amount that is withdrawn from the cost basis amount.

Click the More button. The 3rd data-entry screen specifies how money can be withdrawn. If you select "Withdrawals Are Unrestricted", then the account will be tapped to contribute to retirement living expenses.

Click the More button. The 4th data-entry screen asks for the cost basis of this asset. This can be lower that the starting value entered in the 1st screen. The cost basis is transferred out without any tax deduction. If you add money to this account during its lifetime, the cost basis is increased.

Close the "Long-Term Investment" edit window.

If you click the button to "Calculate The Forecast" you can see the cash flow and the tax treatment. After running the forecast, open the "Long-Term Investment" graph and table window.

The Brokerage account supplies the retirement expenses until it is used up, then withdrawals are taken from the "Long-Term Investment" account starting in 2009. Withdrawals are taxed at the long-term capital gains rate until the funds start to come from the cost basis in 2026, at which point that part is not taxed (there is always a tax for the part that comes from the year's earnings).

A transfer of 40% of the funds is specified to be done in 2029. This is done to show the tax treatment.

Withdrawal Sequence

Changed the Forecaster program to add a new feature that lets you specify the sequence for withdrawing funds for retirement living expenses.

Each year there may be withdrawals specified by you as part of your plan for retirement living expenses. There may also be required withdrawals, such as minimum IRA distributions.

When, at the end of each year, all the plan's specified and required withdrawals do not provide enough funds for your retirement expenses, then additional funds will be withdrawn from your accounts to make up the shortfall.

Your accounts will be accessed in the sequence you specify in the 2nd screen of the "Parameters" data-entry window. A withdrawal will be made from each account in turn to try to cover the entire remaining shortfall balance. This continues until the shortfall is covered, or no more funds are available.

You enter your desired sequence by typing numbers into the boxes on the screen to specify the sequence order. You can rearrange the list of your accounts to be in sequence order by clicking the "Arrange By Sequence" button. But you do not have to rearrange the list to have your sequence numbers be accepted and used by the program.

If you do not specify a sequence, the default sequence will be used. You can click the "Get Default Sequence" button to specify that you want to use the default sequence. The default sequence is determined by a formula that uses the earnings rate and tax rate of each account and tries to minimize the effect of withdrawals on the plan balance over time.

If you are using the default sequence, it is determined before each new calculation of your plan, so if you change the specific earnings rate or specific tax rate of an account, the sequence may change.

Indexed Pensions

Changed the Forecaster program to handle pension payments that are indexed for inflation.

Tax Free Accounts

Fixed the program to correctly handle tax free (e.g. muni bond) accounts. The data entry window for asset accounts now lets you specify that accounts are both federal tax exempt and state tax exempt.